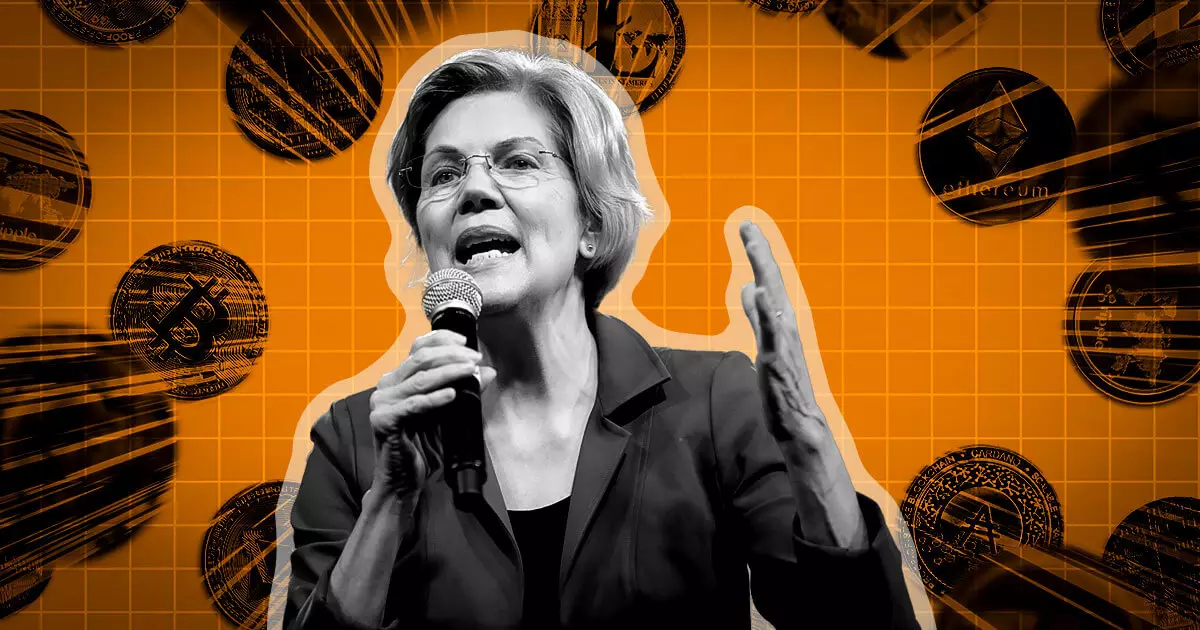

In a recent communication to Treasury Secretary Janet Yellen and IRS Commissioner Daniel Werfel, a group of US Senators, led by Elizabeth Warren, have called for immediate action in implementing new tax reporting requirements for digital asset brokers. These requirements were mandated by the bipartisan Infrastructure Investment and Jobs Act (IIJA) that was enacted almost two years ago, with the aim of addressing the crypto tax gap and streamlining the process for taxpayers reporting crypto income, which is estimated at $50 billion.

Despite the IIJA being passed almost two years ago, the Senators have expressed concerns about the length of time it has taken for the Treasury Department (Treasury) and the Internal Revenue Service (IRS) to publish proposed rules. The Senators emphasized that the implementation deadline is rapidly approaching, with the final rules required to be in place by January 1, 2024. They underscored the need for swift action to enforce robust tax reporting rules for cryptocurrency brokers.

The Significance of the Infrastructure Investment and Jobs Act

The IIJA was initially enacted when the US faced a $1 trillion tax gap, with the emerging and lightly-regulated $2 trillion cryptocurrency sector contributing to this issue. Then-IRS Commissioner Charles Rettig highlighted the need for improved reporting practices to address the tax gap. A Treasury report from May 2021 further emphasized the issue, stating that the anonymity associated with crypto transactions poses a significant detection problem, facilitating tax evasion and other illegal activities. The demand from the Senators for prompt implementation of robust tax reporting rules supports this assessment and aims to address these concerns.

The new rules introduced by the IIJA have significant implications for the crypto ecosystem. They require third-party brokers facilitating crypto transactions to report information related to users’ crypto sales, gains or losses, and certain large transactions to both the IRS and the users themselves. The goal of these rules is to simplify the tax filing process for crypto users and enable the IRS to allocate its resources more effectively to combat large-scale tax evasion. Additionally, these rules are projected to generate an estimated $1.5 billion in tax revenue in 2024 alone, and nearly $28 billion over the next eight years.

The Senators’ letter highlights the urgency in implementing these rules by cautioning that failure to do so by December 31, 2023, could result in a loss of an estimated $1.5 billion in tax revenue in 2024. This underscores the importance of promptly finalizing and enforcing the tax reporting requirements for digital asset brokers.

The call for swift implementation of tax reporting rules comes amidst a broader trend of increased regulatory scrutiny in the crypto industry. Elizabeth Warren’s Digital Asset Anti-Money Laundering Act, supported by Wall Street banks, seeks to impose bank-like standards and requirements on crypto businesses. These developments indicate that the regulatory landscape for the crypto industry in the US is becoming more stringent, with a growing emphasis on traceability, oversight, and visibility.

US Senators, led by Elizabeth Warren, are demanding prompt action in implementing new tax reporting requirements for digital asset brokers. These requirements were mandated by the IIJA to address the crypto tax gap and streamline the reporting process for taxpayers. The delay in implementing the rules has raised concerns among the Senators, who emphasize the need for swift action to enforce robust tax reporting rules. The new rules have significant implications for the crypto ecosystem, aiming to simplify tax filing, combat tax evasion, and generate substantial tax revenue. Failure to implement the rules by the designated deadline could result in a loss of significant revenue. These calls for increased oversight and regulation align with the wider trend in the US crypto industry towards stricter regulatory measures.

Leave a Reply